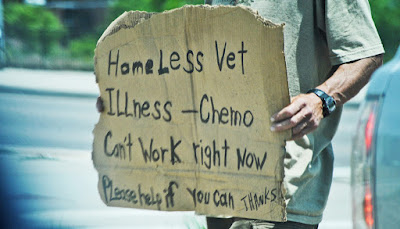

MEDICAL DEBT CAN KEEP PEOPLE HOMELESS LONGER

Clinical financial obligation prolonged people's duration of homeless through approximately 2 years, inning accordance with research study in Washington state's Master Region.

Clinical expenses were actually the main resource of financial obligation amongst individuals in the examine.

dapatkan keuntungan berlimpah main slot

Research study reveals that clinical financial obligation concerns countless Americans: Depending upon exactly just how you specify "clinical financial obligation," research researches coming from nonprofits as well as scholastic organizations typically reveal coming from 16% towards 28% of grownups bring that concern.

As well as clinical financial obligation as well as real estate instability frequently go together.

"Therefore lots of people have actually shed their tasks, and after that they shed their health and wellness insurance coverage. They might certainly not have the ability to pay out also little clinical expenses or even co-pays as well as still have actually lease or even home loan resettlements. If they get ill along with coronavirus, or even a few other clinical problem, this could be the ideal tornado that places individuals out on the road as well as enhances the moment they invest certainly there certainly," states Jessica Bielenberg, that carried out the examine for her master's thesis coming from the College of Washington's Institution of Community Health and wellness.

The examine shows up in Query: The Diary of Health and wellness Treatment Company, Arrangement, as well as Funding.

Little bit of research study has actually been actually performed connecting clinical financial obligation as well as homelessness, Bielenberg factors out. While her examine didn't discover a straight original connection in between both, it performed identify that amongst those experiencing homelessness, the failure towards settle clinical expenses, also a couple of hundred bucks, was actually connected with significantly much a lot extra opportunity invested unhoused.

IN ABOUT ONE-THIRD OF CASES, THE AMOUNT OF MEDICAL DEBT WAS RELATIVELY SMALL—LESS THAN $300.

Bielenberg as well as her coauthors dealt with 2 Seattle companies sustaining shelters as well as encampments for the homeless: SHARE as well as Nickelsville. The group checked 60 grown-up locals around their health and wellness as well as monetary circumstance, consisting of various other financial obligations as well as past times durations of homelessness. Two-thirds of individuals were actually white colored, 15% were actually Dark, as well as 7% were actually Indigenous United states.

Individuals whose clinical expenses possessed been actually sent out towards compilations possessed skilled homelessness for approximately 22 months much a lot longer compared to those that had not possessed such difficulty paying out bills; Dark, Native, as well as individuals of shade that were actually not able towards pay out their clinical expenses stated being actually homeless a year much a lot longer compared to white colored individuals along with the exact very same monetary difficulty.

"If Dark lifestyles truly mattered, our team would not methodically omit those people coming from great jobs—and a great task in The united states is actually a task along with health and wellness insurance coverage," states coauthor Marvin Futrell, a medical trainer in the College of Washington division of hospital as well as an organizer along with SHARE as well as Nickelsville.

In each, greater than 80% of individuals stated possessing financial obligation of some type, like physician expenses, trainee lendings, charge card, or even payday lendings. Of those individuals, 68% stated clinical financial obligation, most of which possessed mosted likely to compilations.

In around one-third of situations, the quantity of clinical financial obligation was actually fairly small—less compared to $300. That highlights exactly just what, for lots of people, could be a domino impact, Bielenberg states: One shed task, or even absence of health and wellness insurance coverage, can easily saddle an individual along with financial obligations they need to focus on, if they can easily pay out all of them whatsoever.

MEDICAL DEBT, HEALTH INSURANCE, AND HOMELESSNESS

Clinical financial obligation is actually a various type of financial obligation compared to, state, exceptional charge card expenses or even trainee lending resettlements, which could be safety versus homelessness in the short-term, Bielenberg discusses. Somebody creating trainee lending resettlements has actually an education and learning, which can easily improve their making energy, while charge card as well as payday lendings can easily deal with fundamental requirements, although they include higher rate of interest. Clinical financial obligation, through its own attributes, comes from a disease or even trauma as well as might follow task reduction or even absence of health and wellness protection.

However exactly just what may be viewed as a security net—health insurance—wasn't constantly that, Bielenberg discovered. Two-thirds of individuals were actually registered in Washington's Medicaid course, Apple Health and wellness, while others got protection coming from Health insurance, the Indian Health and wellness Solution, or even the Veterans Health and wellness Management. Some 16% stated possessing no insurance coverage protection.

Insurance coverage does not constantly deal with whatever, Bielenberg states, as well as the conveniently guaranteed might shed monitor of sets you back that are actually their obligation.

TIME TO CHANGE THE SYSTEM?